Exhibit 2: 60/40 Capital and Risk Allocations || Source: AGAWA Fund Management Inc.

Capital allocation does not maximize diversification of investment and economic risks. A disaggregation of the risk of a 60/40 capital allocation portfolio shows it is still dominated by the equity risks, carrying over 90% equity risk and less than 10% bond risk.

Moreover, given its large risk weighting to equities it is relying on ever rising economic growth in order to deliver satisfactory portfolio returns.

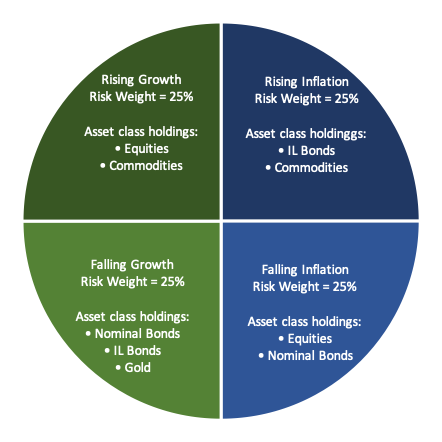

Asset class returns are primarily driven by forecasted economic factors of growth and inflation, a relationship that is often not explicitly considered in the construction of modern-day investment portfolios. Because the changes in these economic factors drive changes in asset prices, for a portfolio to be balanced and diversified it needs to be balanced to the changes and uncertainty in these economic conditions. The short coming of the 60/40 portfolio and the capital allocation approach is a risk profile dominated by equities, and in turn heavily reliant on ever rising economic growth. If growth were to be weaker than expected or falling, or inflation were to be rising, the 60/40 portfolio will not perform well, experiencing significant drawdowns

By allocating assets based on risk, not capital in the asset allocation process, and by balancing the risks to the economic factors that drive asset class returns, investors improve diversification and earn the “market” return more efficiently, with less risk and with smaller drawdowns.

In the AGAWA Core Risk Balanced Portfolio all four sub-portfolios (rising growth, falling growth, rising inflation, and falling inflation) have an equal allocation (25%) as a percent of the total portfolio’s risk, - often referred to a “Risk Parity” - and individually and collectively accrue positive returns over a full economic and market cycle

The enhanced efficiency of the approach and its low correlation to the 60/40 portfolio introduces an opportunity for the investor to “use the risk savings”. The AGAWA Risk Balanced portfolio - either as a core holding or as a satellite position - can now be used to either reduce an investor’s overall portfolio risk or boost overall portfolio returns, or with just a “Pinch of the AGAWA” reduce risk and boost returns, all else being equal.

Traditional 60/40 Portfolio

AGAWA Risk Balance Portfolio

Exhibit 3: Portfolio Sensitivity to Economic Environment || Source: AGAWA Fund Management Inc.